Introduction

Big Motoring World Finance is a large used car dealership in the UK, with multiple locations across the country. They are known for:

- Large selection of used cars: They offer a wide range of makes, models, and price points, making it easier to find a car that fits your needs and budget.

- Financing options: They offer a variety of financing options, including PCP (Personal Contract Purchase), HP (Hire Purchase), and loan purchase, to help you find a way to afford your dream car.

- Part-exchange deals: You can trade in your current car for a discount on a new one, potentially making the upgrade process easier.

- Free servicing offers: Some deals include free servicing for a limited period, which can help save you money on maintenance costs.

- Online resources: Their website allows you to browse their inventory, research car models, and estimate monthly payments, making the buying process more convenient.

However, it’s important to be aware of some potential downsides when considering Big Motoring World:

- Potential for higher interest rates: Their advertised financing rates may not be guaranteed, and the actual rates you receive could be higher, especially if you have a poor credit score.

- Hidden fees: Watch out for additional fees like arrangement fees or early repayment penalties.

- Pressure to buy: Salespeople might use aggressive tactics to try to pressure you into buying a car.

Overall, Big Motoring World can be a good option for some buyers, but it’s important to do your research and compare prices and financing options from other dealerships.

Big Motoring World Finance APR

Big Motoring World, a leading used car dealership in the UK, offers various financing options to help you drive away in your dream car. But before you zoom off the lot, understanding their Annual Percentage Rates (APRs) is crucial.

What is APR?

The Annual Percentage Rate is the cost of borrowing money expressed as per yearly percentage. It factors in not just the advertised interest rate, but also any fees associated with the loan, giving you a more accurate picture of the total cost of financing.

Big Motoring World APR Examples:

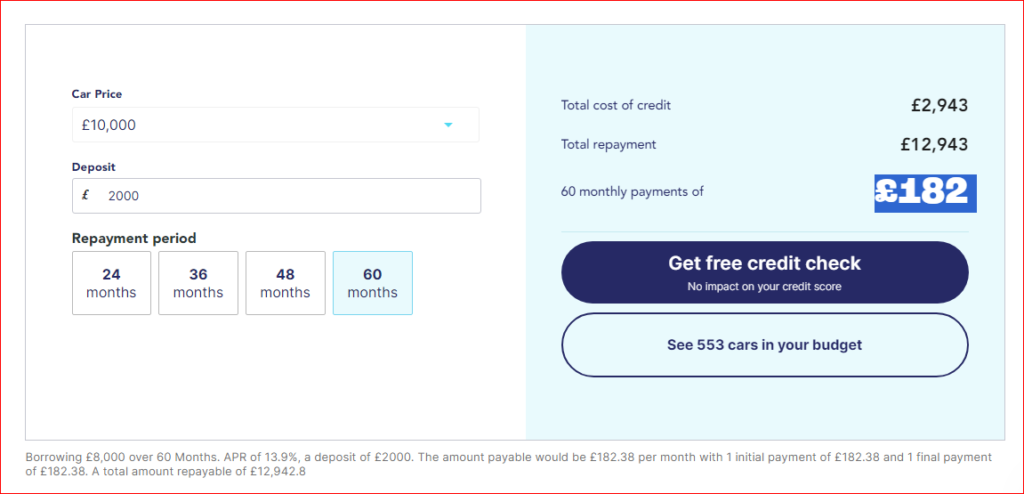

Big Motoring World typically advertises representative APRs, meaning these rates are not guaranteed and may vary depending on your circumstances. Here are some examples:

- PCP (Personal Contract Purchase): 13.9% APR with a £3,000 deposit on a £10,000 car. This translates to monthly payments of around £159.58 for 60 months.

- HP (Hire Purchase): 14.9% APR with a £3,000 deposit on a £12,000 car. This means monthly payments of roughly £186.88 for 60 months.

Factors Affecting Your APR:

Several factors can influence your APR at Big Motoring World:

- Credit Score: A higher credit score generally qualifies you for lower APRs.

- Loan Amount: Borrowing a larger amount typically leads to a higher APR.

- Deposit: Putting down a larger deposit can decrease your APR.

- Loan Term: Longer loan terms often come with higher APRs.

Finding the Best APR

It’s important to compare APRs from various lenders before choosing Big Motoring World Finance. Here are some tips:

- Shop around: Get quotes from banks, credit unions, and online lenders.

- Use online comparison tools: These tools can help you compare rates from different lenders side-by-side.

- Consider a pre-approved loan: Getting pre-approved can give you bargaining power when negotiating with Big Motoring World.

Beyond APR:

While APR is a crucial factor, remember to consider other costs associated with car finance, such as:

- Arrangement fees: Some lenders charge upfront fees for setting up the loan.

- Early repayment fees: If you want to pay off your loan early, you may be charged a fee.

- Optional extras: GAP insurance and extended warranties can add to your overall cost.

Making an Informed Decision

By understanding APR and other financing costs, you can decide whether Big Motoring World’s finance options are right for you.

Drive Away with Confidence

With careful planning and research, you can navigate the world of car finance and secure a deal that puts you behind the wheel of your dream car without breaking the bank. So, buckle up, hit the gas, and enjoy the ride!

Additional Tips:

- Use Big Motoring World’s online finance calculator to estimate your monthly payments based on different loan terms and APRs.

- Read the terms and conditions of any financing agreement carefully before signing.

- If you have any questions about car finance, don’t hesitate to ask Big Motoring World’s staff or an independent financial advisor for help.

Big Motoring World Finance Deals

Big Motoring World offers a variety of finance deals to attract customers, but navigating them can be tricky. Here’s a breakdown:

Types of Deals

- Low APR Offers: Advertised rates typically range from 8.9% to 14.9%, but remember these are not guaranteed and depend on your credit score.

- Deposit Contributions: They might contribute towards your deposit, reducing your upfront cost. Compare the overall loan cost before jumping at this.

- Part-Exchange Deals: Trade in your old car for a discount on a new one. Get independent valuations for your car first.

- Free Servicing Offers: Free servicing for a limited period can be attractive, but consider potential repair costs beyond included coverage.

Things to Be Careful About

- Compare APRs: Don’t just go for the lowest advertised rate. Compare with other lenders and consider the total borrowing cost.

- Hidden Fees: Watch out for arrangement fees, early repayment penalties, or other hidden charges. Get a full breakdown of costs before committing.

- Loan Term: Longer terms mean lower monthly payments, but higher total interest costs. Choose a term you can afford without stretching it too far.

- Deal Conditions: Check eligibility criteria and limitations. Some deals might only apply to specific cars or have minimum financing amounts.

- Alternatives: Consider bank loans or personal loans before committing to Big Motoring World’s deal.

Tips for Making the Most of Deals

- Negotiate: Don’t be afraid to negotiate terms, especially if you have good credit or are considering buying multiple cars.

- Read the Fine Print: Thoroughly understand the terms and conditions of any finance agreement before signing.

- Seek Independent Advice: If you have doubts, consult a financial advisor for professional guidance.

Remember, finance deals can make buying a car more affordable, but they don’t eliminate the cost of borrowing. Choose a deal that fits your budget and long-term financial goals, and avoid getting carried away by attractive offers without considering the full picture.

Conclusion

Big Motoring World Finance presents a tempting gateway to the world of used cars, offering a wide range of vehicles and financing options. However, navigating their “big motoring world” of finance deals can be a complex odyssey, fraught with potential pitfalls.